Credit Sense

Your credit score shouldn't be a surprise. It's essential for your financial well-being, affecting your chances of loan approvals, interest rates, and even renting an apartment. Keep tabs on your credit score with Credit Sense, our free credit monitoring tool. Enroll today - it's simple and takes just a few minutes to set up.

View and Monitor Your Credit Score

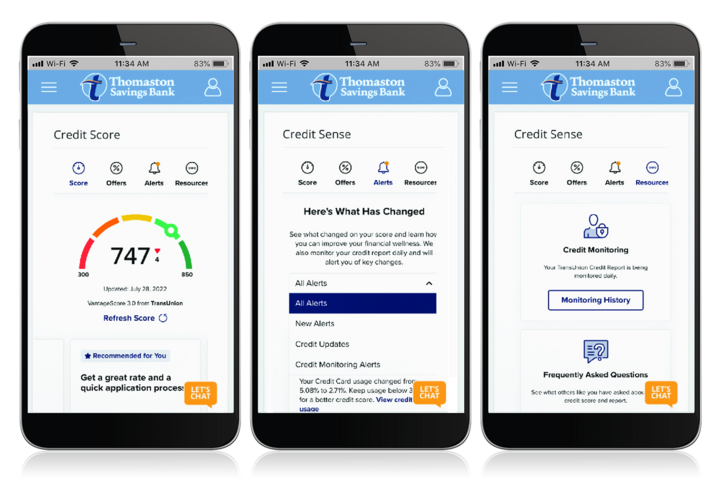

Enrolling in Credit Sense is easy. Just sign in to your Thomaston Savings Bank Online Banking or Mobile App and look for "Credit Score" in your menu options. Once enrolled in Credit Sense, you'll get access to your credit score and report 24/7.

There’s More to Your Credit

Take the hands-on approach to your finances with Credit Sense, available to customers through our Online Banking and our Mobile App.

Review

Gain free access to your credit score and credit report

Identify

Monitor key changes to your credit file with alerts

Analyze

Receive an ongoing analysis of the factors impacting your credit score and resources to help you improve it.

Understanding Credit Reports and Scores

In this course, you will learn the basics of credit management, both holistically and practically.

Take the Next Step

For all of this and more, enroll in Credit Sense within Online & Mobile Banking.

Frequently Asked Questions

A credit score is a three-digit number calculated to indicate your creditworthiness. The higher the score, the more creditworthy you are to a lender. A credit score is calculated from the information in your credit report and takes into account whether you have been making on-time payments, your revolving debt use, the length of your payment history, and other such factors. It is important to know that your score does not take your age, income, employment, marital status, or your bank account balances into account. You can learn more about credit scores and scoring models from the Consumer Financial Protection Bureau website.

Credit Sense uses the VantageScore 3.0 model to generate a score ranging from 300 to 850. VantageScore 3.0 is a credit scoring model developed collaboratively by the three major credit bureaus: Equifax, Experian, and TransUnion.

Credit Sense uses data solely from TransUnion, one of the three major credit reporting bureaus.

There are five major categories that make up a credit score:

40% Payment History

Essentially what lenders want to know is whether or not you’re good about paying your loans on time.

23% Credit Usage

Credit usage, also known as credit utilization, is the ratio between the total balance you owe and your total credit limit on your revolving accounts. It is best to keep your credit usage below 30%.

21% Credit Age

The age of your oldest account, the age of your newest account, the average age of your accounts and whether you’ve used an account recently are all factors related to the length of your credit history. In general, the longer your credit history the better.

11% Mix of Credit

Your score also takes into consideration how many total accounts you have and what types of credit you have. Your score will likely be higher if you have experience with different types of credit, like mortgages and installment student loans and revolving accounts like credit cards.

5% Recent Credit

Opening multiple credit accounts in a short period of time could represent a greater risk for lenders - those who see that you have multiple recent inquiries may worry that you are applying to so many places because you are unable to qualify for credit - or because you need money in a pinch.

These scores can vary by 10-50 points. For more information, go to How Credit Scores Are Created from iFi University.

Were you denied a loan based on credit? Want to better understand your credit score and how to improve it? Check out these free courses and more from iFi University!

• Understanding credit reports and scores

• Using credit cards responsibly

• Mastering credit and optimizing your score

Want to Discuss Your Options?

Fill out the form below to get in touch and find out more about Credit Sense.