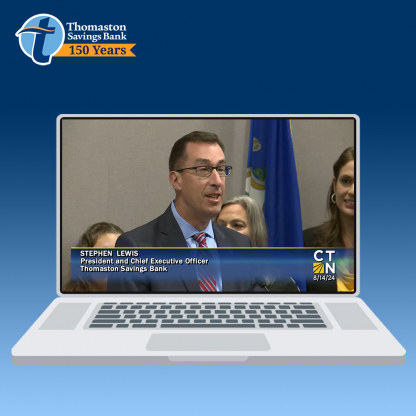

President & CEO Steve Lewis Speaks at Capitol’s Press Conference

Leadership & Team

08/15/2024

Thomaston Savings Bank’s President and CEO Steve Lewis recently spoke at a press conference at the state’s capitol for National Financial Awareness Day. Steve spoke alongside Sean Scanlon, CT State Comptroller; Erick Russell, Treasurer; Arunan Arulampalam, Hartford Mayor; Jorge Perez, Baking Commissioner; Jeff Currey, Representative, and other business executives.

Speakers gathered to celebrate National Financial Awareness Day, an opportunity to stress the importance of financial literacy and sound personal fiscal decisions to promote economic growth and security. The press conference emphasized the importance of beginning discussions around financial literacy at a young age, as well as the new requirement for financial literacy courses for all high school students in Connecticut. The panel also discussed various state and community-level initiatives that are working to help everyone of all ages understand the importance of being financially literate, knowing how to access consumer-friendly financial tools, and further discuss what’s being done in CT public schools regarding curriculum-based learning.

Sean Scanlon, CT State Comptroller, discussed the importance of having a trusted source for financial literacy and education, “local community banks make a big difference in the lives of people across the state. These are people they see in the grocery store. People feel comfortable walking in their branches and Stephen and Thomaston in particular, have done incredible work to partner with Barbara [a teacher and advocate for financial literacy curriculum] and with local school districts.”

“Community banks are here to empower our clients for financial success. We see on a daily basis what the impact of poor financial education and poor financial literacy does to people, creating stress that carries to their family and the community at large.” – Stephen Lewis, President & CEO, Thomaston Savings Bank

Steve also touched on how the Bank combat’s financial illiteracy, “we find a lot of young folks don’t understand basic financial literacy. Our staff works with our clients to assist them in buying their first home, one of the biggest financial decisions of their life. It is important to equip our clients with the resources and products they need to achieve their financial goals.”

Thomaston Savings Bank is dedicated to equipping the community with the products and resources they need to make sound financial decisions. Bank staff present scam awareness and elder abuse seminars for senior citizens through various community centers to ensure they are aware of the dangers and know how to protect themselves. The Bank also partners with youth groups, like the Boys and Girls Clubs, to start building a financial foundation and begin the discussion of financial literacy. The Bank recently has partnered with a local re-entry program to host financial wellness seminars for those previously incarcerated, helping them rebuild their financial stability and confidence in the banking system. These programs reach diverse populations across the state, helping to bridge the gap for financial literacy.

The Bank also has developed consumer-friendly financial tools increasing access to personalized financial education. iFi University, is a free financial education resource available in English and Spanish. This platform can be tailored to the user and provides comprehensive education on key financial concepts, empowering individuals to take control of their financial lives.

Thomaston Savings Bank recently launched the Financial Goal Getter, a tool that offers customized insights helping people understand their next steps on their financial journey. This tool provides valuable resources and connects clients with Bank staff for personalized guidance and support.